2-1 Temporary Buydown

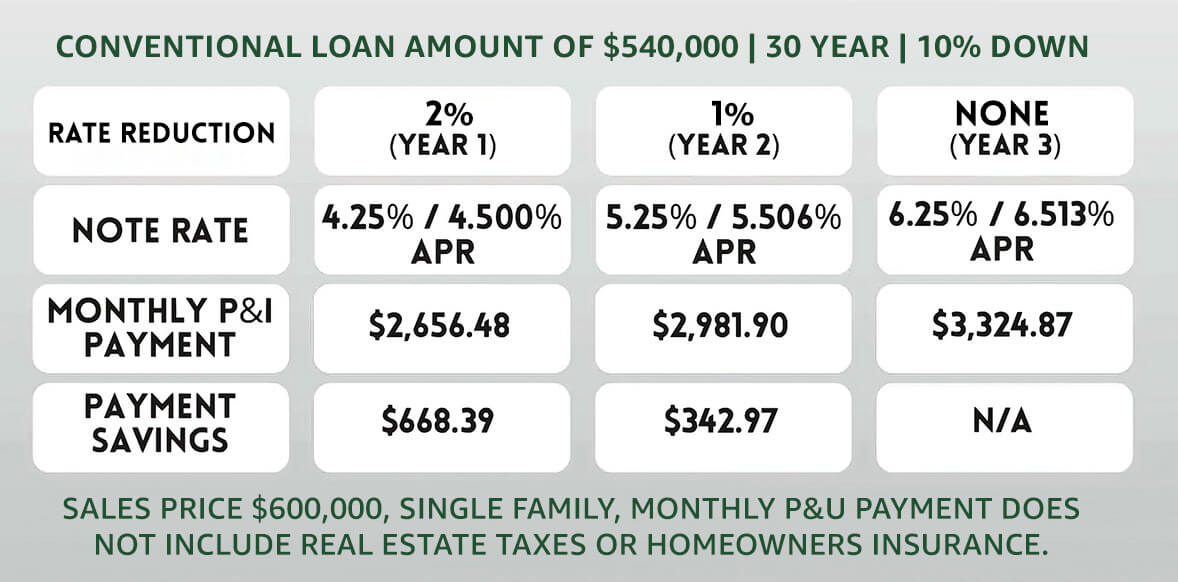

A 2-1 Temporary Buydown is a special type of financing that allows for a buy down of the interest rate for the first two years of your home mortgage. That buy down is paid for by the seller or builder!

We offer a 3-2-1, 2-1, and 1-0 options for flexibility!

Don't Wait, Buy Today! Look at What You Could Save!

2-1 Temporary Buydowns help people qualify for loans!

Interest Payments are reduced for the first two years in exchange for a cash deposit.

Allows the seller or the builder to contribute to your temporary interest buydown.

FNMA, FHLMC, FHA, VA, and USDA fixed rate purchase transactions are eligible

FAQs

What products are eligible for a temporary rate buydown?

FNMA, FHLMC, FHA, VA, and USDA fixed rate purchase transactions

Will BOEM allow a temporary buydown on a refinance?

No. Buydowns are only allowed on purchases

Can a temporary buydown be done on a 2nd home or non-owner occupied property?

No. Primary residences only.

Does BOEM require a separate temporary buydown agreement?

Yes. The disclosure is automatically added to the initial disclosure set.

Should the Note reflect the temporary buydown payment amount?

No. The note will show the permanent payment terms rather than the buydown terms.

Does the payment stream on the LE/CD reflect the reduced payment?

No, the payment on the LE and CD should reflect a fixed payment. The P&I in the Projected Payments section should match the P&I on the Note.

Where would a temporary buydown appear on the LE and CD?

The funds would be considered as a builder or seller credit towards a buyer’s specific cost and should be listed in Section H, “Other”, since this is not a lender required fee.

Who can contribute to a temporary buydown?

BOEM currently allows only the seller or the builder to contribute to the temporary buydown.

If a temporary buydown is seller or builder paid, does that count in the interested party contributions?

Yes, a seller paid temporary buydown is included in the seller contribution limits.

Can a borrower contribute to a temporary buydown?

Not at this time.

Is there a minimum FICO Score?

Follows BOEM minimum credit score guidelines

Can you have a buydown on an ARM loan?

No. Temporary buydowns are only acceptable on a fixed rate loan; ARMs are ineligible.

If the borrower becomes delinquent, can the loan be brought current using the buydown subsidy?

No. None of the Buydown subsidy can be used to pay any delinquency or other amount of the note.